vermont sales tax on alcohol

The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format.

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Department of Taxes.

. Average Sales Tax With Local. Direct Ship to Retail. This means that an individual in the state of Vermont purchases school supplies and books for their children.

Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. 90 on sales of lodging and meeting rooms in hotels. Local Option Meals Tax 9 meals tax 1 10 total tax.

Pay directly to the Commissioner of Taxes the amount of tax on the vinousmalt beverages shipped. Effective June 1 1989. The maximum local tax rate allowed by Vermont law is 1.

6 sales tax 1 7 total tax. For beverages sold by holders of 1st or 3rd class liquor licenses. Local Phone Sales Tax Department.

Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. For all tobacco products except cigarettes there is a 92 wholesale price tax 2 of tax can be deducted if paid up to 10 days before the tax is due. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale.

Delivery in Vermont by the holder of a license shall be deemed to constitute a sale in Vermont at the place of delivery and shall be subject to all excise and sales taxes levied by the State of Vermont. Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. Vermont Meals and Rooms Tax.

Vermont has recent rate changes Fri Jan 01 2021. Certain Municipalities may also impose a local option tax on meals and rooms. Liquor sales are only permitted in state alcohol stores also called ABC Stores.

The first is an alcohol sales tax of 10 plus a 1 local option tax in some cities. Federal excise tax rates on various motor fuel products are as follows. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The primary excise taxes on tobacco in Vermont are on cigarettes though many states also have taxes on other tobacco products like cigars snuff or e-cigarettesThe tax on cigarettes is 275 per pack of 20 cigarettes. Vermont has a statewide sales tax rate of 6 which has been in place since 1969. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities.

Local Option Alcoholic Beverages Tax 10 alcohol tax 1 11 total tax. All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. The state sales tax rate in Vermont is 6000.

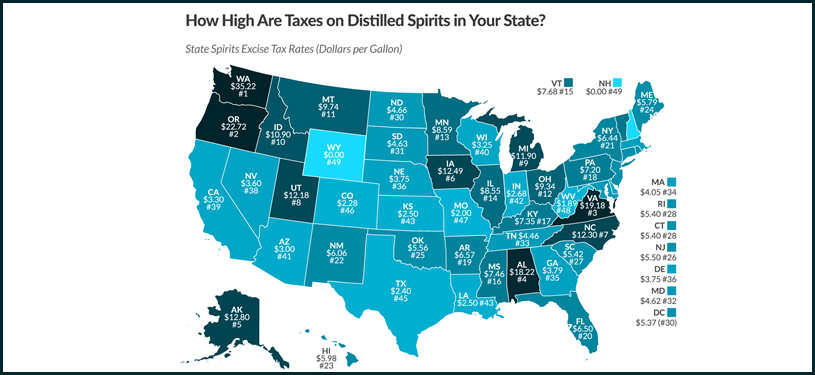

Alcoholic Beverage Sales Tax. The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax. The second is an excise tax which us 27 cents per gallon of beer and 55 cents per gallon of wine.

Vermonts general sales tax of 6 does not apply to the purchase of liquor. Learn more about Vermont Sales and Use Tax. The tax rate is 6.

Vermont Liquor Tax 15th highest liquor tax. 100 on sales of alcoholic beverages served in restaurants. Select the Vermont city from the list of popular cities below to see its current sales tax rate.

Local option tax does not apply to the sale or rental of motor vehicles which are subject to the motor vehicle purchase and use tax. After prohibition many states chose to resume the legal sale of alcohol through licensed private sellers. Vermont has state sales tax of 6.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. 90 on sales of prepared and restaurant meals. Eighteen states including Vermont and a few local jurisdictions opted for a different course control.

Sales and Use Tax 32 VSA. While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on.

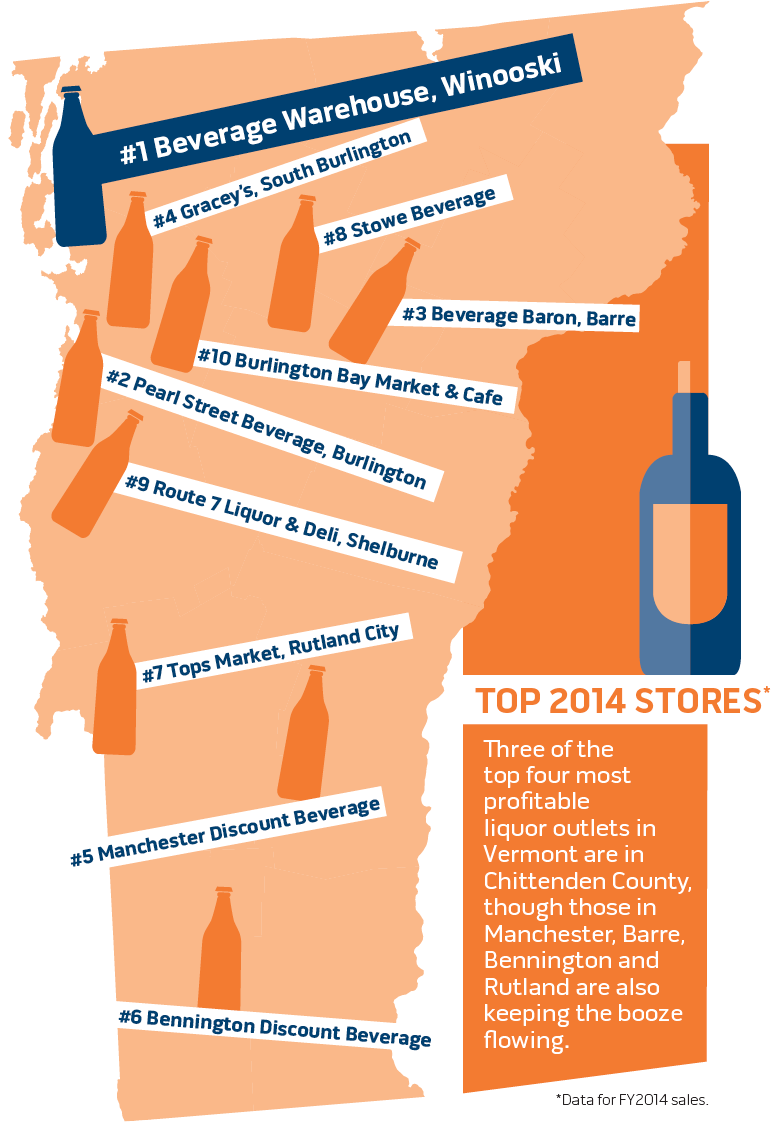

See definition at 32 VSA. The Office of Education provides education services to licensees bartenders servers store clerks consumers parents teenagers and anyone else who needs to know how to make sure alcohol. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states.

Any private person entity institution or organization selling meals serving alcohol or renting rooms to the public must collect the Vermont Meals and Rooms Tax from their customers on their gross receipts and remit the tax. Toll Free Phone Sales Tax Department. Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption.

Control States are jurisdictions that directly control the distribution and sale of beverage alcohol within their borders. The price of all motor fuel sold in Vermont also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. The Essex Junction Sales Tax is collected by the merchant on all qualifying sales made within Essex Junction.

Tax Rates for Meals Lodging and Alcohol. The Division of Liquor Control is responsible for the sale of spirits and the enforcement of laws and regulations regarding alcohol and tobacco in Vermont. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0092 for a total of 6092 when combined with the state sales tax.

Local Option Rooms Tax 9 rooms tax 1 10 total tax. With local taxes the total sales tax rate is between 6000 and 7000. Beer and wine which are not part of the control system face two types of taxes in Vermont.

Use tax has the same rate rules and exemptions as sales tax.

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Historical Vermont Tax Policy Information Ballotpedia

When Did Your State Adopt Its Sales Tax Tax Foundation

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Alcohol Taxes On Beer Wine Spirits Federal State

These States Have The Highest And Lowest Alcohol Taxes

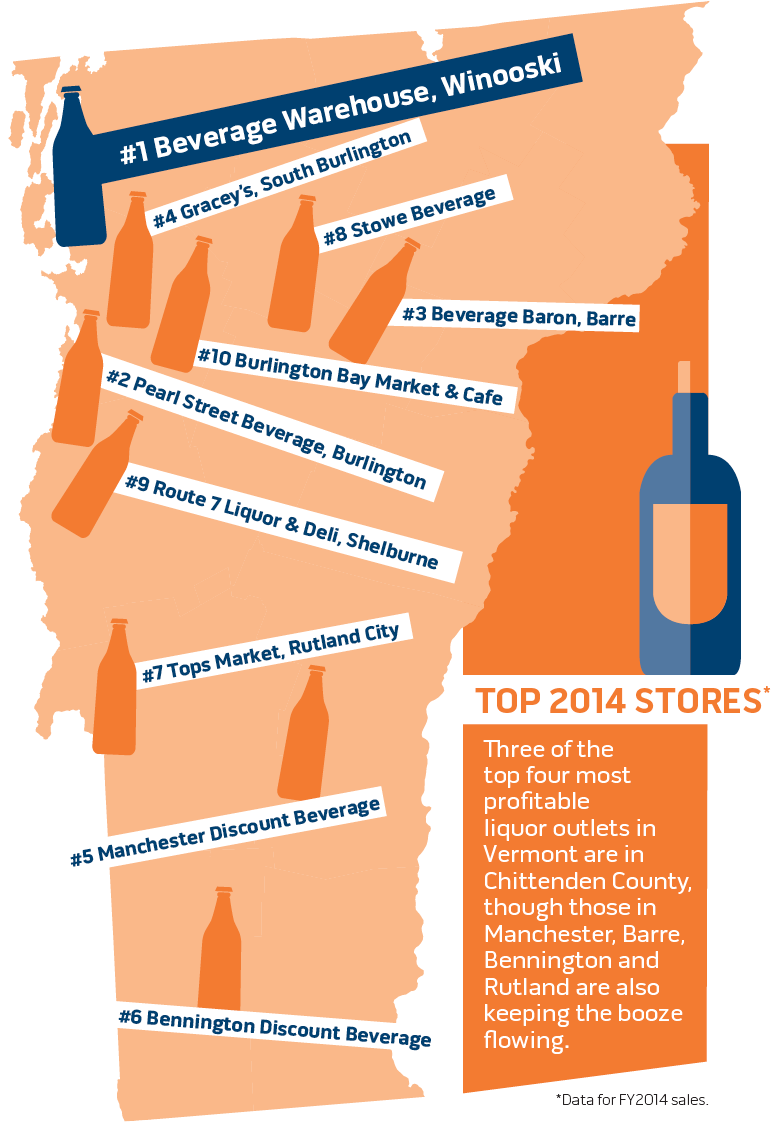

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Printable Vermont Sales Tax Exemption Certificates

How Much Does Your State Collect In Sales Taxes Per Capita

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax On Grocery Items Taxjar

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Sales Taxes In The United States Wikiwand

Liqour Taxes How High Are Distilled Spirits Taxes In Your State